Retailers´ profit margins sustained by fiscal support

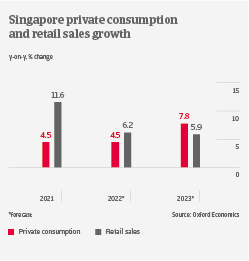

Retail sales in Singapore rebounded by more than 11% in 2021 after a 16.4% slump in 2020. The recovery is likely to slow down in 2022, as higher inflation could affect discretionary spending, while the spread of new Covid variants remains a downside risk. A slower recovery of global economy and international travel continues to pose challenges for an economy that heavily relies on external trade and tourism. However, according to Statistica, the 2022-2025 compound annual growth rates for furniture, consumer electronics, and household appliances are 18%, 8.7% and 16.5% respectively.

Retailers are currently facing higher costs for energy, and it remains to be seen if they can pass on higher input prices to end-customers. While supply chain disruptions remain an issue, businesses have learnt their lesson from the serious supply chain bottlenecks at the height of the pandemic. Retailers have started to stock up their inventories early, ahead of festive peak seasons like the Chinese New Year, for example. This reduces the impact of supply chain issues on revenues and profits. Given the growing importance of online sales, most brick-and-mortar retailers try to compete with their online peers by collaborating with e-commerce platforms. We expect that brick-and-mortar retailers will increasingly adapt to new strategies in order to increase their online sales and to remain competitive.

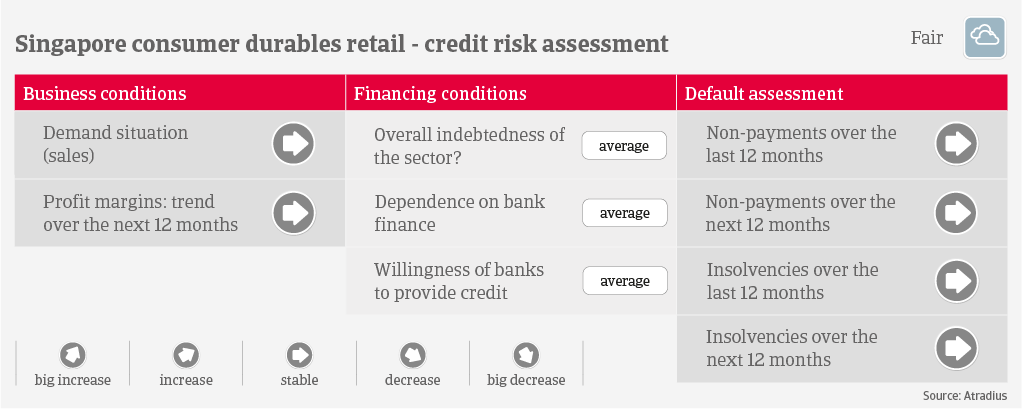

Most retailers have been able to sustain their profit margins during the past two years, strongly supported by comprehensive fiscal stimulus. Payments in the consumer durables retail industry take 60-90 days on average, and there has been no increase in payment delays. While some retailers had to file for bankruptcy last year due to losses, most businesses have managed to stay afloat thanks to fiscal measures. We do not expect a deterioration of the insolvency environment this year, because the government has again earmarked support for Singaporean businesses in its Financial Year 2022 budget.

Given the current credit risk situation and the ongoing growth prospects in 2022 and beyond, our underwriting stance is open to neutral for businesses across all main subsectors.