The construction materials subsector clearly benefits from increased building material prices, and elevated costs are expected to persist throughout 2019.

- Slower, but still robust growth expected in 2019

- Payment terms have increased

- No insolvency increase expected in 2019

In 2018, value added in the US construction industry grew a solid 3%, with increased construction spending across almost every region and project type. In Q1-Q3 of 2018 construction spending increased 7% year-on-year for public building and 5.1% for private construction. Public works and institutional building both had reasonable gains in 2018 following surges in 2017, and recently passed appropriations will carry into 2019. Residential project spending increased 6.4%.

That said, higher mortgage rates have somewhat constrained growth potential of the housing market in 2018. Tighter inventories and price increases have left some first time homebuyers out of the market until wage growth catches up. However, multi-family housing has partially compensated lower growth in the single-family homebuilding segment.

In 2019 construction spending growth is expected to continue (up 4.8%), although at a slower pace than in 2018 (expected up 6.5%). Lower economic growth, workforce shortages, higher interest rates and uncertainty over trade policies could have a dampening effect on output expansion.

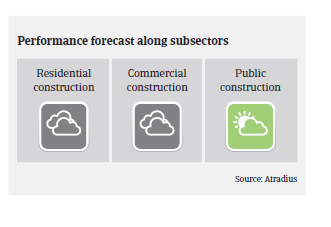

Residential construction is expected to grow modestly on the back of wage growth, low unemployment, and low inventories, while higher interest rates have an adverse effect. Non-residential construction is projected to continue its improvement, largely supported by the USD 305 billion FAST (Fixing America’s Surface Transportation) Act. Commercial construction growth is expected to decrease slightly in 2019 due to higher office vacancies as the economic expansion slows down.

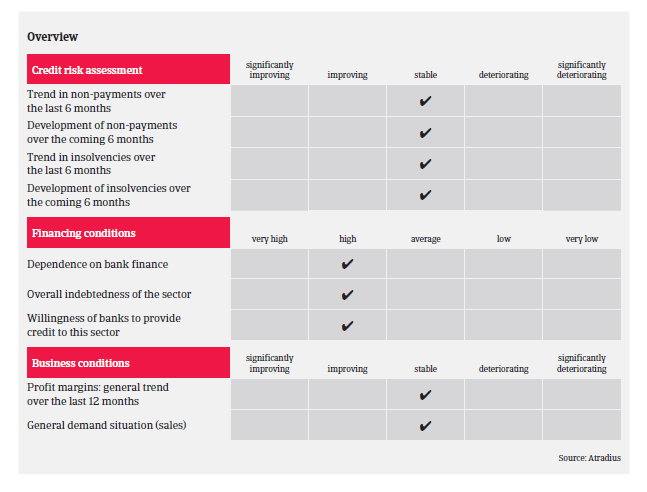

Both construction businesses leverage and dependence on bank financing are generally high, and banks are generally willing to provide loans to the sector. Companies that show consistent profitability, healthy balance sheets and prompt payment trends are generally able to obtain ample lines of credit. Profit margins are expected to remain stable in 2019, as most businesses are able to pass on higher commodity costs (also triggered by imposed import tariffs on steel and aluminum) to their end-customers. The construction materials subsector clearly benefits from increased building material prices. Elevated costs are expected to persist throughout 2019.

Payments in the industry have slowed to 54 days on average, as longer terms have increasingly become a method of attracting business from end-customers. Payment experience in the construction sector has been decent in 2018, and the overall number of payment delays and insolvencies is expected to level off in 2019.

While we continue to increase our risk appetite in the industry, caution is still taken with smaller construction businesses, which show above average bankruptcy rates. When available, financial statements are to be reviewed annually with supplemental soft credit information reviewed more frequently. Trading experience is used to gain a better comfort level in gauging the relationship between our customers and their buyers. Reduction or withdrawal of cover is considered if a buyer shows significantly worsening results, which may include losses, unsustainable capital structures, liquidity issues, or deteriorating payment trends.

İlgili dökümanlar

1.19MB PDF